do you pay property taxes on a leased car

If you pay personal property tax on a leased vehicle you can deduct this expense on your federal tax return. You pay personal property taxes on the vehicle unless otherwise stated in your lease.

Property Tax Check How To Calculate Property Tax Online In India

In some states.

. The Internal Revenue Service requires that these deductible ad valorem taxes be based on the value of the car and be levied by the state each year. Ad 0 Down Specials - Expert Car Reviews on 1000s of Cars. For example if your local sales tax rate is 5 simply multiply your monthly lease payment by 5 and add it to the payment amount to get your total payment figure.

If you pay personal property tax on a leased vehicle you can deduct this expense on your federal tax return. If you purchase a vehicle instead of lease it you are paying sales tax on the entire value of the vehicle sales tax in Connecticut is 635 or 775 for vehicles over 50000 and it is based on the purchase price. Get Connected to Local Dealers Today.

Your cars worth will be taxed at 25 per 1000 dollars. If that is the case then my cost-basis lease payments residual would be more than the sale and I would have a loss and therefore. Posted at 1549h in Properties by Carolyn 0 Comments 0 Likes No but yes.

Some leased vehicles may qualify for Personal Property Tax Relief as provided in 581-3523 etseq. Ad All Remaining 2022 Models Must Go. No tax is due on the lease payments made by the lessee under a lease agreement.

Some build the taxes into monthly lease payments as landlords build real estate taxes into monthly rent payments while others pay the tax and then bill the lessee for the tax payment. When you rent a car the dealer always retains ownership. But most of Connecticuts 71 independent fire departments do.

Exclusive Savings on All Car Models. This assumes 14000 is the cost-basis. Tax is calculated on the leasing companys purchase price.

You must indicate the deductions in Schedule A to make this depreciation. Vehicles leased to a person versus a business and used predominantly for non-business purposes may qualify for car tax relief. However some believe lease payments should be included in the cost-basis.

Find Los Angeles Car Dealers Get Quotes Now. Many districts especially those formed by owners or homeowners associations do not tax motor vehicles. The Internal Revenue Service requires that these deductible ad valorem taxes be based on the value of the car and be levied by the state each year.

If you pay vehicle taxes for a vehicle valued at more than 4000 you can use the appropriate value for personal property taxes deducted at that states tax rates. In most states both car purchases and leases are subject to sales tax. In car leasing how the sales tax is calculated and when it needs to be paid may vary from state to state.

The Internal Revenue Service requires that these deductible ad valorem taxes be based on the value of the car and be levied by the state each year. You must indicate the deductions in Schedule A to make this depreciation. Connecticut car owners including leasing companies are liable for local property taxes.

13 Mar Can You Deduct Property Taxes Paid On A Leased Vehicle. The leasing company may use the fair market value deduction to reduce the vehicles taxable value. Most leasing companies though pass on the taxes to lessees.

You will have to pay personal property taxes on any vehicle you do not register. This means you only pay tax on the part of the car you lease not the entire value of the car. Do I owe capital gains tax on the 8000 gain.

You must indicate the deductions in Schedule A to make this depreciation. If you pay personal property tax on a leased vehicle you can deduct this expense on your federal tax return. If you lease a vehicle in Connecticut you arent paying sales tax on the value of the entire vehicle.

Also no tax is due by the lessee on the purchase of a motor vehicle for lease in Texas. After a couple weeks I sold the car for 22000.

Property Tax Appeals When How Why To Submit Plus A Sample Letter

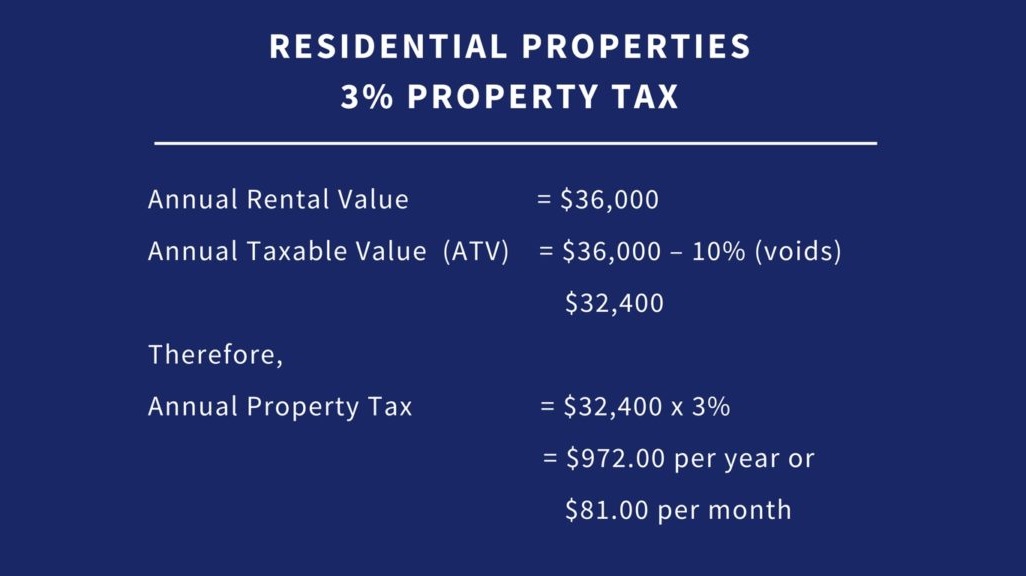

Ultimate Guide To Understanding South Carolina Property Taxes

Updated 10 Things To Know About Property Tax Loop Trinidad Tobago

Local Business Taxes Real Property Tax Ppt Download

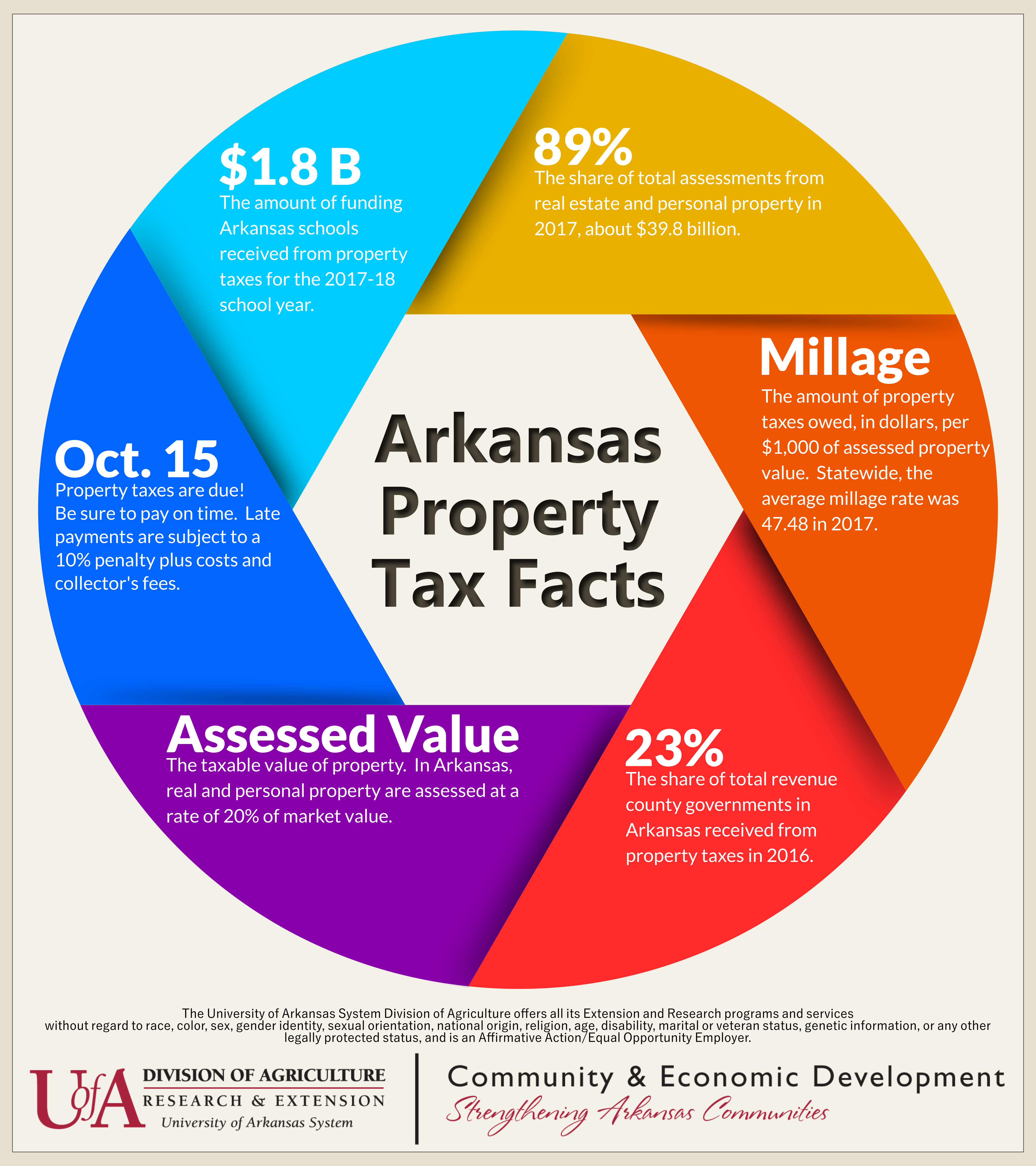

Understanding Your Arkansas Property Tax Bill

What You Need To Know About Condo Property Tax

Pdf Land And Property Tax A Policy Guide

Real Estate Property Tax Constitutional Tax Collector

Personal Property Tax Jackson County Mo

Understanding California S Property Taxes

Online Real Estate School Mortgage Training Real Estate School Online Real Estate Mortgage

Pay Personal Property Tax Help

Understanding California S Property Taxes

Business Personal Property Tax How To Maximize Your Efficiency

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Florida Property Tax H R Block

Which U S States Charge Property Taxes For Cars Mansion Global